Welcome to our critique of capitalism. As you read and scroll through the material please notice that we steer clear of ideological attacks and instead try step back and take a fresh look at our economic system impartially, as if we might be encountering it for the first time. We urge you to do the same. Although difficult, and some would say impossible, try to remove your rose-colored glasses and see with the honest eyes of a child. We begin by first asking the question:

I don't think so, protest though some might. In order to answer that question we have to fully understand what capitalism actually is. We routinely think of it as a scientific system of exchange whose origins are traced to Adam Smith, commonly thought of as the “father of modern economics” but who thought of himself as an 18th century Enlightenment philosopher of ethics and morals, as did his contemporaries like his good friend David Hume. With the publication of Smith’s Wealth of Nations we began the modern era of continuous prosperity, so the thinking goes, brought to us by the power of free markets. And we believe that with the collapse of the Soviet Union, socialism/communism, its mirror image and only competitor, has been vanquished, proven false and relegated to the dustbin of history, suitable now only to demonstrate the veracity of capitalism. See there: particular private property is the only way to achieve freedom and order. Collectivity is demonstrably tyrannical. Progress belongs to the victorious. |

"As Karl Polanyi described in his 1944 book, The Great Transformation, 'To allow the market mechanism to be sole director of the fate of human beings and their natural environment . . . would result in the demolition of society...'"

|

|

Many may think that capitalism is complicated, that the now global interplay of finance, goods and services, resources, labor and people is knowable only to the very best and the very brightest. It is the capitalists who proffer this complexity, and this belief, to their distinct advantage, enabling them to prosper in a surely dynamic world.

But capitalism is actually very simple, so simple in fact that its essence lies hidden among the growing heap of models and data, policies and politics, lobbying, laws and regulations, and endless news stories about jobs, the economy and life in all its true complexity. Capitalism is the progeny of the separation of Capital from Labor. That's all. * What then is Capital? Capital is a construct, a posit, an idea, a made-up entity that we have agreed to collectively imagine. Capitalism is the worshiping of that idea, of that postulate. Capital is a pure product of the imagination that breathes singular life into the inanimate, into money—or more properly, representations of money. Capital is accounting entries come to life. Capital cannot just be, instead it must move, it must be invested and therein lays the mystery and power of our imaginary creation. Capital has a telos: it has its own mission and goal, it must compound, infinitely. Reproduction is its single attribute and as such its ends and means are the same. In practice it creates all necessary structures to ease its reproductive path. Woe to any manager who fails to achieve returns to Capital—to grow his Capital. Such neglect of his ward will bring a flock of suitors who promise to better care for this petulant figment of our presently collective imagination. Capitalism is immensely powerful. All would agree that it has shaped our world from our cultures and institutions to our environment, globally. When Capital comes to a field, the field changes; when Capital comes to a neighborhood, the neighborhood changes—likewise when capital leaves... Wherever Capital goes change follows—its telos is always felt. We have to stand in awe of its power. Capital is amoral—not immoral—though what it does may often be so construed, it doesn’t have any sense of itself whatsoever. It is innocent, as one might be of a crime by reason of insanity. But we have given it the right to exist in the world—it has become deeply embedded in our culture and in our language. And we cotton to it by giving it inalienable rights and privileges. Moreover it is said when Capital is free we are free. We even write books about it proclaiming how essential its free existence is to our free existence. Capitalism and Freedom, argues Milton Friedman, is best thought of as an eternal bond. So our world is richer for our creation; we have plants and animals, rivers, mountains, oceans and insects…humans and Capital. Of all these Capital is the most powerful. It stands next to God as a pure being. * Whoever can lay hands on Capital wields a measure of its power—and those who best fully grasp and identify with its essence find immense power. Many have thought that we can fertilize and grow the common good with its telos—in fact harnessing the power of money is the liberal political agenda. But as we have seen, such agendas have been crushed in recent history—thirty years for starters—though we can trace a timeline going back much farther. Capital is too wily a beast—its single property too powerfully simple. Even the best Samaritans who agree to Capital’s liberation find their work Sisyphean. Whether they work towards charitable or environmental ends, every time they get their rock up the hill, it rolls back down on them. War, poverty, inequality and environmental destruction carry on as before. And they turn again to beg of this amoral entity more means towards their just ends. * By splitting the labor/capital atom we have put in place an increasingly furious chain reaction, only now becoming fully visible. It is an unleashing of power which only a few can control and it should not be surprising that it is those few who reap the rewards. Who then among us would claim filial affinity to this insatiably rapacious simplicity? Who would claim their sole mission in life, their teleology, is to multiply without rest and without end? * Whoever Holds Kinship Holds Power We have to ask, and then observe, who best among us grasps the teleology of capital? Here think of an athlete: the aggressive sprinter possessed of solid thigh muscles, the marathon runner patient, sinewy and lean. We know them and their attributes, both mental and physical enable their excellence in their chosen sport. What then can we say of capitalists? To the extent they are driven to unfettered reproduction they are close kin to capital—they share its single and simple attribute. The very best are unencumbered by strings of morality and social convention—ideally they would have no strings at all. Again, it’s not that capitalist athletes are immoral, but rather amoral, naturally exhibiting the properties of their profession. They are single-minded. We wouldn’t expect a sprinter to be distracted by some mishap in the stands and nor should we expect a capitalist to be distracted by the amount of carbon in the atmosphere or the destruction of the middle class, let alone the suffering poor. Thus we must observe that the capitalist sees the world as Capital sees the world: as a reductionist in pursuit of reproduction. Hawk-eyed and simple. Nothing can be denied access to its productive capability and anything can be created in its service. Mountains moved, rivers reversed, technologies produced, ideas, cultures, governments and peoples created and destroyed. All in the service of its teleology. * The instrument of the capitalist is price, the common denominator within which economists tell us, is found all the information we need to know. Telling! Capitalists are the Grand Simplifiers who parse and parcel according to the efficiency of price to enable themselves the most profitable reproductive reassembly. Theirs is the re-creative power of God. Since the process is the same the results look the same, the world over. And so within our bio-diverse and complex world we see a spreading homogeneity, begun as development, and then heralded as progress, now a torrent of scorched earth and blacktopped banality whose purpose reflects the purpose of its creator. Globally. Capital cannot abide diversity. * The power of the Grand Simplifier has surpassed that of the Grand Inquisitor for he is the ultimate arbiter, able to put to death and eliminate anything that cannot be made productive. His power is not limited to saviors and sinners but includes all entities, from flora and fauna to social relations and people and geographies, technologies, jobs and ideas. Is it then any wonder that ardent capitalists exhibit such infallible confidence? Just as the Grand Inquisitor offers his flock a circumscribed world of imaginary freedom, so too does the Grand Simplifier circumscribe the world in imaginary freedom. Increasing productivity and growth sit at the right and left hand of this father and these are solemnly good, apriori. He keeps all within the orbit of His arms, within the flow of markets, which encompass all that needs to be known about the world. His teleology becomes culture: the endless production and consumption of goods and services. The word "goods" well chosen for it is an adjective masquerading as a noun—thus any material possession is good—a tempting tautology. The use value of goods and services are by their nature limited—how much of anything can any person use? And so something had to be done to overcome this contradiction of His essence. Through the transubstantiation of advertising, which now saturates the World, use value becomes comparatively meaningless, replaced by symbolic values, thus exciting endless exchange; perpetual creation and destruction, in true manifestation of His essence. Ideally the flock ceases to exist as persons. Infatuated with symbols people become consumers, whose servitude and debt in pursuit of symbols are born-again as virtuous work and honorable obligation, and most of all, as illusory happiness, and so, they become trapped in Capital's aspirational web. Production is the master; consumption the servant. There are no other possible worlds, we are assured; it is, after all, science we are told. Capital exists. We have no choice but to acquiesce. * And indeed we find all the religions of the world complicit in this comparatively new creed, hostage to and fearful of its power--and perhaps, not a little envious. Knowing their flocks are dependent, so too they are dependant. Just revolt remains remote; their past history of questioning science has not worked out well, so they remain quiet minding their own business: the carting over to another world in which it is not clear whether Capital exists or not. Perhaps they should ask. Miraculously, periodic objections swell defiantly and sometimes with great hope in the face of the amoral tide. Stop! There must be some limits--humans can only bear so much. Such entreaties come from many and varied quarters but all objections become subsumed, however well plotted or passionate they may be. Even major reforms leave in place the ontological entity, Capital, that then begins to attract its human kin—the pleonexic—who begins again the quest for eternal reproduction and growth; a remaking of the world in Capital’s own image. * So I ask again: Are you a capitalist? And my hope is that you are not. My hope is that your essence is not the essence of cancer cells and that your complexity dazzles me even if some of your attributes unsettle me. We can exchange goods and services. And we might even use a proxy for value—though we don’t have to. But there is no reason to grant that proxy independent corporeal existence. And to imbue Capital with rights, with freedom, is the chimerical delusion of those most kin to Capital—the pleonexic psychopaths. There is no reason to name that into existence and set it loose on the world. It can be mine, and it can be yours. But capital can’t live outside of us, disembodied, lest it attract those least like us, and we all suffer and serve the tyranny of its simplicity and perish within its contagion of its life-crushing homogeneity. Capital threatens our planet and us. * I’m betting you’re no kin to Capital, that you have known the warmth and love of your friends and family, and the peace of satiety. It is my fondest wish that be so. tecumseh ©2012 EJ Tangel Essay in PDF EJ Tangel is founder and editor of the Tecumseh Project.org, environmental/social justice activist and ex-securities trader; a degree in philosophy and masters in liberal studies, inspired by Occupy and faithful about the end of neoliberalism and rule by its pleonexic practitioners and apologists. |

Climate and Capitalism

|

"Where is the outrage? The crypto-fascists have us living in a hyper-marketized, hyper-capitalized society...greed is running amok...congress is the site of legalized bribery and normalized corruption. How long can this fragile experiment in democracy survive the oligarchic economy?"

- Cornel West, Mandel Hall, Univ. of Chicago. May 7, 2012

"Corporations, long identified as our principal economic actors, are now also our principal political actors. The result is a combined economic and political system—the operating system upon which our society runs—of great power and voraciousness, pursuing its own economic interests without serious concern for the values of fairness, justice, or sustainability that democratic government might have provided."

- James Gustav Speth, America the Possible

"Fascism should more appropriately be called Corporatism because it is a merger of State and corporate power."

- Benito Mussolini

"Capital is an absentee slumlord"

- EJ Tangel

"Do people exist to serve the economy? Or should the economy exist to serve people?"

- David Korten, author of Agenda for a New Economy, in PBS interview

America the Possible: A Manifesto, Part I

|

|

Robert F. Kennedy on the values we measure; Univ. of Kansas March 18, 1968

|

...burgeoning aggregate wealth increasingly concentrated in fewer hands. Yet the health of a society has always depended on how widely wealth is shared, how much respect is accorded all its members and how compassionate it remains to those in need. An economy beholden to capital cannot share wealth, nor be compassionate because it is fundamentally pleonexic and psychotic, run by pleonexic psychotics. Capital is single-minded: it must forever accumulate and grow, its efficiency dependent on eradicating all obstacles in its ammoral path. In a multifarious and radically diverse world, capital alone is singular and seeks to recreate our world in its image. See our essay, A Fractured Fairy Tale: Pleonexia and the Psychopath.

|

"Poverty and wealth are merely names for want and satiety. Hence, neither rich are those who want more, nor poor those who want nothing."

--Democritus, Ethica 5th Century, B.C.E.

(Read it again...please)

--Democritus, Ethica 5th Century, B.C.E.

(Read it again...please)

Add demand-side essay: How capitalism projects its efficient division of labor to division of consumers, a process of unifying its teleology, two sides of the same coin. Thus we have technologies that actively divide while claiming to unite, again a contradiction so common in ideological discourse. The homogeneity of individuals, communities, county and world is achieved through dividing all into parts easily reassembled. Perhaps this essay can introduce:

In each of these books below and the New York Times articles that follow, the authors describe how the growing sophistication of data collection and management, and the proliferation of individuated technology-based communication generates huge profits for corporations at a terrible cost to people. The process severs our ability to communicate in meaningful ways and fundamentally re-shapes us both as human beings and communities of human beings as well. This is an example of demand-side productivity within capitalism. For capital, it is not only the production process that must be maximized--as production is made more profitable by division of tasks,

so too are people made more profitable when they are divided. In order to maximize returns, capital must maximize consumers--the more units the better. Capital must separate us.

But more alarming is that by separating us and collecting and manipulating data, corporations are able to actually reshape people into more profitable consumers. The more each unit consumes the greater capital fulfills its reproductive teleology. Any loss of community and meaningful connections is of no concern to capital. And any human traits that cannot be made profitable have to diminish to the point of non-interference with capital's teleology. Capital must simplify us. Capital creates the world in its own image. |

|

|

|

You for Sale: Mapping, and Sharing, the Consumer Genome, Natasha Singer. Sunday Business, NYT June 17, 2012 (Repost from NYT)

Steve Howe, CEO Acxiom;

It peers deeper into American life than the F.B.I. or the I.R.S., or those prying digital eyes at Facebook and Google. If you are an American adult, the odds are that it knows things like your age, race, sex, weight, height, marital status, education level, politics, buying habits, household health worries, vacation dreams — and on and on.

Photo credit, Steve Keesee, AK Democratic Gazette Right now in Conway, Ark., north of Little Rock, more than 23,000 computer servers are collecting, collating and analyzing consumer data for a company that, unlike Silicon Valley’s marquee names, rarely makes headlines. It’s called the Acxiom Corporation, and it’s the quiet giant of a multibillion-dollar industry known as database marketing. Few consumers have ever heard of Acxiom. But analysts say it has amassed the world’s largest commercial database on consumers — and that it wants to know much, much more. Its servers process more than 50 trillion data “transactions” a year. Company executives have said its database contains information about 500 million active consumers worldwide, with about 1,500 data points per person. That includes a majority of adults in the United States..." Continue reading this must read article which describes the "sophisticated ecosystems" that these companies create in which they parse and parcel to simplify our nature in their endless quest for profit maximization. Like Turow's book, The Daily You, New York Times writer Natasha Singer describes the process by which we are being recreated as entities that maximize Capital's reproduction--a process that accumulates data (largely without our knowledge) and then feeds it back to us, a process that reconstructs us psychologically, physically and philosophically. It is a building of a simulacra for profit. Remember, consumption is the servant, production the master. "Scott E. Howe, the chief executive of Acxiom...sees the company as a new millennium 'data refinery,' rather than data miner."

|

How Companies Learn Your Secrets

|

Liquidated: An Ethnography of Wall Street

|

Source: Reflection of Me

|

Capitalism Beyond the Crisis, Amartya Sen

NYRB March 26, 2009

In this article Noble Laureate economist and Harvard professor Amartya Sen reacts to the economic crises by questioning the premises of modern capitalism in part by delivering a solid, if short, historical analysis of Adam Smith's ideas. He notes for example, that Smith's Wealth of Nations (1776) was preceded by his Theory of Moral Sentiments (1759), and was wholly dependent on this earlier work. Smith's "overwhelming concern--and worry," Sen writes, was "about the fate of the poor and the disadvantaged..." Smith was "a defender of the role of the state in providing public services, such as education, and poverty relief...he was also deeply concerned about inequality and poverty that might survive in an otherwise successful market economy." Smith was aware of, and deeply concerned about likely over-speculation and warned of excessive risk sought by "prodigals and projectors." Sen also says that Smith never used the term "capitalism", and argues that he also never suggested "the sufficiency of market forces," for social relations, "or of the need to accept the dominance of capital." (emphasis the editors) This is a critical for our understanding of economics today.

Adam Smith was an Enlightenment moral and ethical philosopher. His title as "the father of modern economics" came much later, part of a process that stripped his thoughts of their complexity and their humanity. This is the work of the Grand Simplifiers, who now rule the world, the very "prodigals and projectors" Smith so solemnly warned us about. In fact, Smith's invisible hand belonged to God, an omni-benevolent being, and its manifestation was the "fellow feeling" among people...that is, their natural compassion and inclination to do the right thing. Smith did not invent Capitalism and would have nothing but contempt for its worshipers today.

There is a difference between market economies and capitalism. The former privileges people, the latter creates Capital as an ontological being, establishes itself as a secular religion, and privileges those who share its single attribute: the pleonexic. EJT

Adam Smith was an Enlightenment moral and ethical philosopher. His title as "the father of modern economics" came much later, part of a process that stripped his thoughts of their complexity and their humanity. This is the work of the Grand Simplifiers, who now rule the world, the very "prodigals and projectors" Smith so solemnly warned us about. In fact, Smith's invisible hand belonged to God, an omni-benevolent being, and its manifestation was the "fellow feeling" among people...that is, their natural compassion and inclination to do the right thing. Smith did not invent Capitalism and would have nothing but contempt for its worshipers today.

There is a difference between market economies and capitalism. The former privileges people, the latter creates Capital as an ontological being, establishes itself as a secular religion, and privileges those who share its single attribute: the pleonexic. EJT

|

"Turn on, tune in and drop out." Timothy Leary PhD

|

Your work enriched the 1%...STOP: Intentional "recession" is the best way to take power away from the 1% and place it in our (your) hands; their wealth and power depends on our work, our consumption, our compliance with, and our belief in their system. It is a fraudulent and life-destroying system.

|

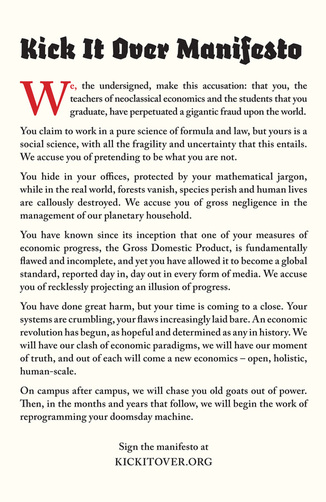

Be sure to checkout their link..."Adbusters invites economics students around the world – especially PhD students – to join the fight to revamp Econ 101 curriculums and challenge the endemic myopia of their tenured neoclassical profs...download the [manifesto] and pin them up in the corridors of your department...Put your university at the forefront of the monumental mindshift now underway in the 'science' of economics."

|

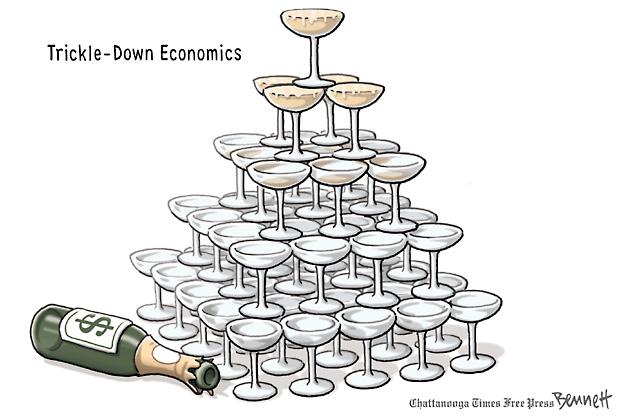

How Capitalism Works:

|

The Wrecking Ball of Innovation, Tony Judt

A review of Robert Reich's Supercapitalism: The Transformation of Business, Democracy and Everyday Life

New York Review of Books December 6, 2007

In this wide ranging review, written before the economic crisis, Tony Judt, professor of European Studies at New York University, and a Fellow of the American Academy of Arts and Sciences, reveals the deeply held beliefs and assumptions clung to by even our most liberal economists. Judt lambastes Reich for giving into the tautology that capitalism is a good for its own sake. Reich's Supercapitalism is just the natural progression of a natural phenomena, and though Reich does a good job of elucidating the debilitating consequences of the resultant inequality, his prescription to address these ills are both superficial and weak amounting to the great majority of us becoming better, more active and diligent citizens on the watch.

"Reich's categories [for action] faithfully reflect his epistemologically thin view of society: by 'citizen' he means no more than economic man + enlightened self-interest" and fails to acknowledge that "The market requires norms, habits, and 'sentiments' external to itself to hold it together to ensure the political stability that capitalism needs in order to thrive." Here again we find resonance with Adam Smith's forgotten principals. That the market cannot supply many goods was well known to Smith (schools, roads, etc.) but Judt adds that the market has become like a secular religion, discarding anything without a direct value for its own reproduction--that is, productivity and growth. Our normative framework on which exchange must be securely fastened is being "undermined"--the market "cannot reproduce the noncommercial institutions and relations--of cohesion, trust, custom, restraint, obligation, morality, authority--that it inherited..."

And so Judt says our present looks a lot like our past: in the Middle Ages the Church dictated an ironclad world view from which the Enlightenment freed us. But capitalism, especially Supercapitalism, returns us to a similar box, this one wholly reductionist, beholden to productivity and growth, and without room for normative ideals. A secular clerisy has replaced the clerics and our eschatology is now endless growth.

Judt wants us to survive this onslaught, as human beings. "The idea of a society held together by pecuniary interests alone is, in Mill's words, 'essentially repulsive.' A civilized society requires more than self interest, whether deluded or enlightened, for its shared narrative purpose." And he argues that we desperately need increased public participation--our democracy is under assault from our economic system itself which has turned into a tool or method of oppression and fear (e.g. of unemployment and being at the mercy of globalization). We cannot accept Supercapitalism but instead our economy must be made subservient to the general welfare, subordinate to meaningful lives. "If modern democracies are to survive the shock of Reich's 'supercapitalism,' they need to be bound by something more than the pursuit of private economic advantage, particularly when the latter accrues to ever fewer beneficiaries..."

EJW

"Reich's categories [for action] faithfully reflect his epistemologically thin view of society: by 'citizen' he means no more than economic man + enlightened self-interest" and fails to acknowledge that "The market requires norms, habits, and 'sentiments' external to itself to hold it together to ensure the political stability that capitalism needs in order to thrive." Here again we find resonance with Adam Smith's forgotten principals. That the market cannot supply many goods was well known to Smith (schools, roads, etc.) but Judt adds that the market has become like a secular religion, discarding anything without a direct value for its own reproduction--that is, productivity and growth. Our normative framework on which exchange must be securely fastened is being "undermined"--the market "cannot reproduce the noncommercial institutions and relations--of cohesion, trust, custom, restraint, obligation, morality, authority--that it inherited..."

And so Judt says our present looks a lot like our past: in the Middle Ages the Church dictated an ironclad world view from which the Enlightenment freed us. But capitalism, especially Supercapitalism, returns us to a similar box, this one wholly reductionist, beholden to productivity and growth, and without room for normative ideals. A secular clerisy has replaced the clerics and our eschatology is now endless growth.

Judt wants us to survive this onslaught, as human beings. "The idea of a society held together by pecuniary interests alone is, in Mill's words, 'essentially repulsive.' A civilized society requires more than self interest, whether deluded or enlightened, for its shared narrative purpose." And he argues that we desperately need increased public participation--our democracy is under assault from our economic system itself which has turned into a tool or method of oppression and fear (e.g. of unemployment and being at the mercy of globalization). We cannot accept Supercapitalism but instead our economy must be made subservient to the general welfare, subordinate to meaningful lives. "If modern democracies are to survive the shock of Reich's 'supercapitalism,' they need to be bound by something more than the pursuit of private economic advantage, particularly when the latter accrues to ever fewer beneficiaries..."

EJW

Market Man; What did Adam Smith really believe? by Adam Gopnik.

The New Yorker review of Nicholas Phillipson's Adam Smith: An Enlightened Life (Yale University Press 2011)

"...By cutting off 'The Wealth of Nations' from his other great book, 'The Theory of Moral Sentiments,' we not only cut off one half of Smith’s mind from the other but lobotomize our own understanding of modern life, making economics into a stand-alone statistical quasi-science rather than, as Smith intended, a branch of the humanities. Phillipson’s new biography tries, very successfully, to pull together the two Smiths, letting us see how the man of feeling became the little god of finance. Tells about Smith’s childhood in Scotland, his friendship with philosopher David Hume, and the development of his ideas. Discusses the three main arguments Smith advances in 'The Wealth of Nations.'"

The New Yorker review of Nicholas Phillipson's Adam Smith: An Enlightened Life (Yale University Press 2011)

"...By cutting off 'The Wealth of Nations' from his other great book, 'The Theory of Moral Sentiments,' we not only cut off one half of Smith’s mind from the other but lobotomize our own understanding of modern life, making economics into a stand-alone statistical quasi-science rather than, as Smith intended, a branch of the humanities. Phillipson’s new biography tries, very successfully, to pull together the two Smiths, letting us see how the man of feeling became the little god of finance. Tells about Smith’s childhood in Scotland, his friendship with philosopher David Hume, and the development of his ideas. Discusses the three main arguments Smith advances in 'The Wealth of Nations.'"

|

This is a must watch and must share video. While Annie Leonard doesn't specifically mention capitalism, it is exactly what she is describing...

Story of Stuff Annie's Home Page...check it out. |

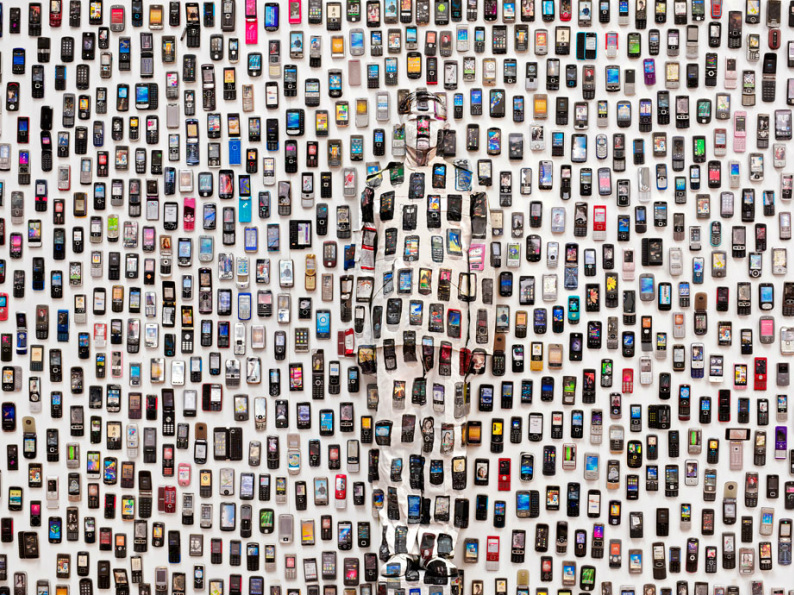

Apple fan? Watch this short clip, Sixteen Hundred iPhones a Day, from UsAgainstGreed. Capitalism depends on resource exploitation, human and natural.

|

Great Books

The Enigma of Capital, David Harvey Oxford University Press 2010

The most obvious causes of the current financial crisis are the technological and organizational changes over the last thirty years empowering finance and solidifying a state-finance nexus, says David Harvey in his book The Enigma of Capital. The underlying cause—the core of the problem—is that capital has cornered too much power inflicting itself with an effective demand problem that it relieved with widespread indebtedness.

But this is an opportunity, one that hasn’t come along since at least the 1930’s, and Harvey is cautiously optimistic and determined to take advantage of it. This is the exegesis of Enigma. By elucidating the inherent contradictions within capitalism, Harvey hopes to make clear that it not only doesn’t fulfill its promise of prosperity but also that it causes widespread harm. Periods of prosperity spread wealth unevenly while engendering poverty and a host of ills. Periodic episodes of collapse are endemic to capitalism and the occurring ever more frequently concentrating pain throughout the working class—that is, everywhere outside the capitalist class. Driven by both coercive competition and the inherent need to reinvest its profits Capital must find a way around barriers of geography, regulation, the environment and so on.

Harvey hopes a fuller understanding of the system that causes crisis will open a space for change--and indeed, nothing less than a complete reorganization of the economy, and all its related spheres is required.

According to Wiki: "David Harvey…is the Distinguished Professor of Anthropology at the City University of New York (CUNY). A leading social theorist of international standing, he received his PhD in Geography from the University of Cambridge in 1961. Widely influential, he is among the top 20 most cited authors in the humanities…His world has contributed greatly to broad social and political debate…He is a leading proponent of the idea of the right to the city (A movement that claims a right of access to, and development of common space belongs in the hands of the community, enabling their “collective power to reshape the processes of urbanization.” (Wiki) EJW

But this is an opportunity, one that hasn’t come along since at least the 1930’s, and Harvey is cautiously optimistic and determined to take advantage of it. This is the exegesis of Enigma. By elucidating the inherent contradictions within capitalism, Harvey hopes to make clear that it not only doesn’t fulfill its promise of prosperity but also that it causes widespread harm. Periods of prosperity spread wealth unevenly while engendering poverty and a host of ills. Periodic episodes of collapse are endemic to capitalism and the occurring ever more frequently concentrating pain throughout the working class—that is, everywhere outside the capitalist class. Driven by both coercive competition and the inherent need to reinvest its profits Capital must find a way around barriers of geography, regulation, the environment and so on.

Harvey hopes a fuller understanding of the system that causes crisis will open a space for change--and indeed, nothing less than a complete reorganization of the economy, and all its related spheres is required.

According to Wiki: "David Harvey…is the Distinguished Professor of Anthropology at the City University of New York (CUNY). A leading social theorist of international standing, he received his PhD in Geography from the University of Cambridge in 1961. Widely influential, he is among the top 20 most cited authors in the humanities…His world has contributed greatly to broad social and political debate…He is a leading proponent of the idea of the right to the city (A movement that claims a right of access to, and development of common space belongs in the hands of the community, enabling their “collective power to reshape the processes of urbanization.” (Wiki) EJW

Buy "The Enigma of Capital here": betterworldbooks.com/

David Harvey: The Crisis of Capitalism, sketch lecture by RSA Animate.

|

"The Enigma of Capital"

|

|

|

|

What Can Economists Know? Rethinking foundations for economic understandingsGerd Gigerenzer, PhD

INET Conference, Berlin April 12, 2012. A critically important talk given by psychologist Gerd Gigerenzer on the efficacy of economic decision-making that effectively demolishes the foundation of current economic thinking. |

"Almost all neoclassical, neuro-economics and behavioral economics

makes decisions based on risk—that is, when all alternatives, all consequences

and all probabilities are known." Modeling works with risk, but not Uncertainty, argues Gigerenzer. And of course the world is filled with uncertainty, of which, the recent near-collapse of the financial system is just one example. And we would add, proof of the immeasurable hubris of Wall Street. But this hubris is not limited to Wall Street, it pervades our entire economics because it is built on economists' ability to model reality. This modelling of reality, actually creates reality, a world of pleonexia, competition and collapse.

Heuristics are better, Gigerenzer argues. “We must dare a science of heuristics…which are normative…and how most humans and animals make decisions most of the time." Gigerenzer is arguing for a human understanding of the world. Recognizing both our limits and our strengths he favors simplicity, "complex problems don’t require complex solutions...and "very often less can be more.” EJW -GERD GIGERENZER is Director of the Center for Adaptive Behavior and Cognition at the Max Planck Institute for Human Development in Berlin |

Another picture from Liu Bolin...in Slate Magazine